For that reason, the share of borrowers from A selection of backgrounds who were behind on their own payments in the fall of 2021 declined relative to before the pandemic. Additionally, borrowers who experienced superb university student loan personal debt at enough time on the study described increased amounts of financial well-remaining as opposed with prior yrs.

Note: Amid Grown ups with a minimum of some credit card debt outstanding for their own individual training or possibly a Kid's or grandchild's training. Some people experienced multiple type of debt.

Like debt exceptional for that borrower's instruction, debt for a child's or grandchild's training might be in forms other than a pupil loan.

Although it is frequent to aim only on These with fantastic credit card debt, many people who borrowed for their training had repaid their loans absolutely. Excluding these Individuals who have paid off their financial debt could overstate problems with repayment.

The self-assessed worth of greater schooling was decrease amid people that experienced remarkable financial debt. Amongst borrowers with exceptional financial debt, 40 percent said some great benefits of their education and learning exceeded the associated fee. This was under the 63 percent of borrowers who completely compensated off their debt and fifty one per cent of individuals who went to school but by no means experienced credit card debt.

A chance to evaluate and comment is extended to ALTA Associates and field consumers right before final publication. The kinds, in general, are created obtainable for customer usefulness. The functions are free in Each and every scenario to conform to distinctive conditions, and the use of these forms is voluntary, Unless of course essential by legislation.

In case you are a Member, Licensee, or Subscriber and would want to entry all of the forms, only Log In to take pleasure in usage of each of the sorts.

ALTA’s primary purpose is to assist our title business members succeed professionally. ALTA has cultivated a number of resources to assist ALTA users evaluate, increase and expand their organization. ALTA’s suite of resources will help you at any phase of your small business enterprise.

An profits-pushed repayment (IDR) prepare bases your regular monthly college student loan payment with your revenue and loved ones dimension. In the event you repay your loans under an IDR plan, any remaining equilibrium on your own pupil loans will likely be forgiven Once you make a particular quantity of payments over 20 or 25 yrs—or as number of as 10 years less than our latest IDR plan, the Conserving on a Precious Schooling (SAVE) System.

Per the coed loan payment reduction and improvements in payment statuses, self-noted economic properly-currently being between Older people with superb personal debt has amplified around the pandemic.

If you're employed full time for just a govt or nonprofit Business, you may qualify for forgiveness of all the remaining stability of one's here Immediate Loans after you’ve designed 120 qualifying payments—i.

Consult a Tax Skilled: If the forgiveness is probably going to occur in 2026 or later, commence planning for a potential tax Invoice now. A specialist will let you estimate your tax liability and system appropriately.

Empowering you with trusted loan possibilities tailor-made to your needs. Our seamless process makes sure brief approvals, connecting you with reliable lenders for problem-totally free financial methods. FAQ

Forgiveness in 2025: Maria has become on an Revenue-Pushed Repayment program for twenty years and qualifies for forgiveness in November 2025. Due to the fact this falls before the close in the tax exemption, the forgiven equilibrium isn’t taxable, and Maria doesn’t owe anything at all extra at tax time.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Andrew Keegan Then & Now!

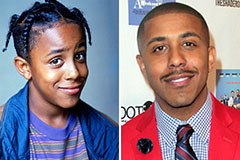

Andrew Keegan Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!